This is an excellent book which can help you to improve your relationship with Money. In this book author has provided 9 Steps to transform your Relationship with money and achieving Financial Independence

The Money Trap: The Old Road Map for Money

MONEY: The Tender TRAP? “Your Money or your Life.” If someone thrust a gun to your ribs and said those words, what would you do? Most of us would turn over our wallers. The threat works because we value our lives more than we value our money. Or do we?

Most of us cling as long as possible to the notion that there is a way to live that makes more sense, that brings more fulfilment and has more meaning, but over time, as our jobs wear a groove into our lives and our days fill with to-dos, the idea that we could have a more rewarding existing seems to fade.

There is a way to live an authentic, productive, meaningful life – and have all the material comforts you want or need. There is a way to balance your inner and outer lives, to have your job self be on good terms with your family self and your deeper self. There is a way to go about the task of making a living so that you end up more alive. There is a way to approach life so that when asked, “Your money or your Life?” you say, “I’ll take both, thank you.”

We Aren’t Making a Living, We’re Making a Dying: For so many people, however, from people who love their work to those who barely tolerate their jobs, there seems to be no real choice between their money and their lives. What they do for money dominates their waking hours, and life is what can be fit into the scant remaining time.

We Think We Are Our Jobs: We take our identity and our self-worth from our jobs, that’s why we respond to that getting-to-know-you question “What do you do?” with “I am a ………..”. Whether we realise it or not, our daily interactions involve the unconscious sizing up of how each of us “makes a living”.

The High Cost of Making a Dying: Psychologist Douglas LaBier documented this “social disease” in his book Modern Madness. Focusing on money/ position/ success at the expense of personal fulfilment and meaning had led to 60% of us to suffer from depression, anxiety, and other job-related disorders, including the ubiquitous “stress”.

Even though the official workweek has been pegged at 40 hours for nearly half a century, many professionals believe they must work overtime and weekends to keep up. We are working more, but enjoying life less. The Result? We have developed a national disease based on how we earn money.

What Do We Have to Show for it? Even if we aren’t any happier, our savings rate has actually gone down.

We Make a Dying at Work so We Can Live it Up on the Weekend: Consider now that average consumer, spending his or her heard-earned money. On Weekends. The bottom line is that we think we work to pay the bills – but we spend more than we make on more than we need, which sends us back to work to get the money to spend to get more stuff – that sends us back to work again!

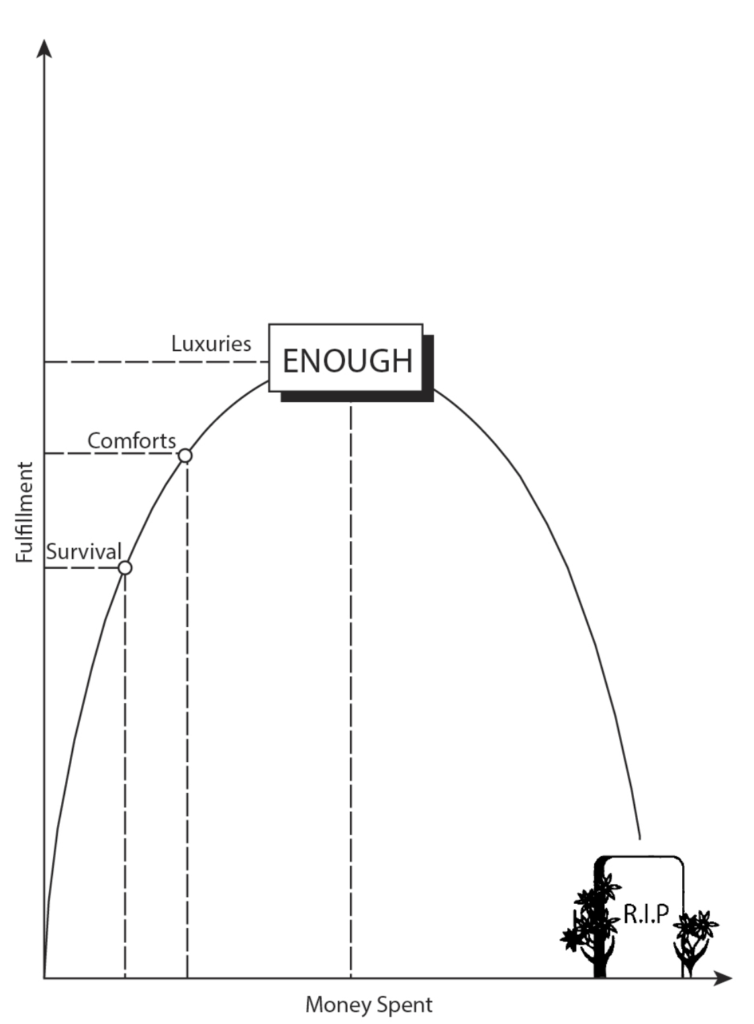

What About Happiness? If the daily grind were making us happy, the irritations and inconveniences would be a small price to pay. But clearly it is becoming increasingly clear that, beyond a certain minimum of comfort, money is not buying us the happiness we seek.

Is More Better? Many of us are out there making a dying because we’ve bought into the pervasive consumer myth that more is better. We build our working lives on this myth of more. We will get greater responsibility and more perks as we move up in our field. We become habituated to expecting ever more of ourselves and even more from the world, but rather than satisfaction, our experience is that the more we have, the more we want – and the less content we are with the status quo.

“More is better” turns our to be a formula for dissatisfaction.

The Limits to Growth: Our economy’s version of “more is good” is “growth is good”.

The Creation of Consumers: We meet most of our needs, wants, and desires through Money. We buy everything from hope to happiness. We no longer live life. We Consume it.

What Do Our Actions Say? What do we do when we are depressed, when we are lonely? when we feel unloved? More often than not we buy something to make us feel better. When we want to celebrate, we buy something. When we are bored, we buy something. When we think there must be more to life, we buy something. We have learned to seek external solutions to signals from the mind, heart or soul that something is out of balance.

As you follow the nine steps outlined in this book, you will develop your own personal definition of clutter and will slowly, painlessly, even joyfully rid yourself of it.

Step1: Making Peace with the Past

Are you ready to survey your own relationship with money and the things that money can buy? The purpose of this exercise is to increase your awareness, not only your arrogance or your shame. It helps you to locate yourself in time and space, to review – without blame – your earning and spending activity in the past.

There are two parts to this step:

A. Find our how much money you have earned in your lifetime – the sum of your gross income, from the first penny you even earned to your more recent paycheck.

B. Find our your net worth by creating a personal balance sheet of assets and liabilities.

A. How MUCH MONEY YOU HAVE EARNED IN YOUR LIFE? Go down your memory lane, find out how much you have earned, dig out your old copies of income tax, any jobs that paid you under the table, informal consulting, gambling winnings, gifts from relatives that went unreported, any money you’ve stolen, cash prizes you’ve won, rent collected from the extra room in your house and all other unreported income. The object is to get as honest a figure as possible for the total amount of money that has entered your life.

The Value of Step 1: This step is useful in several ways

- It clears that fog shrouding your past relationship with money. Most people have no idea how much money has entered their lives.

- It eradicates myths and false concepts as “I can’t earn very much money”.

- It gets you to ground zero, enabling you to begin the financial program with a clear head and confidence in your wage-earning ability.

- It allows you to see and let go of any skeletons from the past you may have in your closets – any secrets or lies that may be distorting your current relationship with money.

B. WHAT HAVE YOU GOT TO SHOW FOR IT? For the years you have been working for wages, a certain amount of money (which you just calculated) has entered your life. The amount that is left in your life now is your net worth.

Creating a snapshot of your net worth simply means going through your material universe and listing everything you own (assets) and everything you owe (liabilities):

- Liquid Assets

- Fixed Assets

- Liabilities

- Net Worth: (Liquid Assets + Fixed Assets) – Liabilities

Money Ain’t What it Used to Be – and Never Was

Every moment a pinch of money moves in or out, much of it out of sight and mins as electronic beeps. It’s easy for us to identify money in our lives, but what is it really? What does it represent?

- Money or something you trade your life energy for. You sell your time for money. The only real asset you have is your time. Three hours of your life.

- Money is like water – it flows, and it flows, it nourishes life. We feel happy when it flows our way, distressed when it doesn’t.

- The more we clarify this watery-feeling aspect of money, the better equipped we are to deal with those hard daily transactions.

- Money is a game and we have to play by the rules. Like it or not, we are all in the money game.

A FIRST LOOK AT FINANCIAL INDEPENDENCE: Only when we take personal responsibility for our relationship with money does the first definition of true financial independence appear. Financial independence has nothing to do with rich. It is the experience of having enough- and then some.

Financial and psychological freedom: Your first step toward the experience of having enough – and then some – is liberating your mind from its preexisting attitudes towards money. Until you do so, no amount of money frees you. Once you have, you are free from unconsciously held assumptions about money, and free of the guilt, resentment, envy, frustrating and despair you may have felt about money issues. You are not longer compelled by the parental and social messages you received as a child – messages about how we should relate to money in order to be successful, respected, virtuous, secure and happy. You are not longer intimidated by the financial professionals you hire to do your taxes or invest your money. You never buy things you don’t want or need, and you are immune to the seductiveness of malls, markets and the media.

When you are financially independent, the way money functions in your life is determined by you, not by your circumstances. In this way money isn’t something that happens to you, it’s something you include in your life in a purposeful way.

Financial Independence is freedom from the fog, fear and fanaticism so many of us feel about money.

Step 2: Being in the Present – Tracking your Life Energy

Step 2 on the road to financial freedom is where you satisfy this curiosity. There are two parts to step 2:

A. Establish the actual costs in time and money required to maintain your job(s), and compute your real hourly wage.

B. Keep track of every cent that comes into or goes out of your life.

A. HOW MUCH ARE YOU TRADING YOUR LIFE ENERGY FOR? Most people look at this life-energy-to-earnings ratio in an unrealistic and inadequate way: “I earn a thousand dollars a week, I work forty hours a week, so I rage one hour of my life energy for twenty-five dollars.” It’s not likely to be that simple. Think of all the ways you use your life energy that are directly related to your money earning employment. Think of all the monetary expenses that are directly related to you money-earning employment.

- Be prepared to discover how much you spend with “I hate my job” as an underlying reason.

- Be prepared too, to discover how much you spend on expensive alternatives to cooking, cleaning, repairs, and other things you would do yourself, if you didn’t have to work.

Include the amount of money you are spending on commutation, the amount of money you are spending on clothes which you otherwise don’t wear on your day offs or on vacations; Money for afternoon or morning coffee, cafeteria, meals ordered in or eaten out, money you are spending on escape entertainment, vacations, job related illness and other job related expenses

Clearly the bottom line is this that you are actually selling an hour of your life energy for $10, not apparent $25. Your real hourly wage is $10 – before taxes, even! (you should make this calculation every time you change your job – or change your job-related habits.)

This step puts paid employment into perspective and points out how much you are actually getting paid. Also, it appears you to access current and future employment realistically, in terms of actual earnings. Knowing the financial bottom line for your job will help you to clarify further your motives for working and for selecting one job over another.

B. KEEP TRACK OF EVERY CENT THAT COMES INTO OR GOES OUT OF YOUR LIFE: The second part is simple but not easy. We need to keep track of every cent that comes into or goes out of your Life. Many people intentionally remain aloof regarding money.

The practice is simple: Keep track of every cent that comes into or goes out of your life. There is no right way to do it – whatever works best for you is the best method. Whatever system you choose, do it (the program works only if you do it!) – and be accurate.

“Why,” you must ask, “do I need to go such great lengths?” Because it’s the best way to become conscious of how money actually comes and goes in your life as opposed to how you think it comes and goes. Your commitment to clearing up your relationship with money is really tested here.

Where Is It All Going?

After looking at Step 1 and Step, in this section we will looking at Step 3, where you’ll need to call on more of yourself to make it work. Here you’ll being the process of evaluating the information you’ve collected.

DO YOU NEED A BUDGET? This approach to money is actually the opposite of a budget. Budgeting is a planning tool, while this program is an “awareness of your enough point” tool. Unlike a budget, step 3 in this program gives you the freedom of getting clear about money without cutting off a lot of individuality and creativity. Think of it as the difference between dieting and mindful eating. In mindful eating, you slow down, pay attention to what you are actually hungry for.

This financial program points you in the same direction as mindful eating:

- You need to identify and follow internal signals, not external admonishments or habitual desires.

- You need to observe and adjust your patterns of spending over the long term, not what you spend over the short term.

Step 3 is where you begin the exercise these awareness muscles.

Step 3: Monthly Tabulation

In this step you will establish spending categories that reflect the uniqueness of your life. The Fun – and challenge – of this step will come in discovering your own unique spending categories and subcategories. The subcategories will be like an encyclopedia of your unique spending habits.

TOTALLING IT ALL UP: Once the categories are created start tracking your transactions whether by hand or machine. At the end of the month transfer each month entry from your tracking system into the appropriate column on your Monthly Tabulation. Add up your income and expenditures column and enter the total of each sub-category at the bottom of that column. Then add the totals for all expenditure categories – this sum is your total monthly expenses.

THE BALANCING ACT: Next, count the cash in your wallet and bank and note that balance of your checking and savings accounts. Now you have enough information to see how closely you have kept track of the money flowing into and out of your life over the past month.

How Much Is Enough? The Quest for Happiness

What fills us with happiness – or fulfilment. Fulfilment is our compass and our rudder for transforming our relationship with money.

For many of us, growing up has meant outgrowing our dreams – or having them shrink in the face of harsh circumstances or people. Wherever you are, take a few moments now to reflect upon your dreams. Can you remember what you wanted before you were told to grow up and fit your round peg in square cubicle? Use these questions to trigger memories and stimulate thoughts:

- What did you want to be when you grew up?

- What have you always wanted to do that you haven’t yet done?

- What have you done in your life that you are really proud of?

- If you knew you were going to die within a year, how would you spend that year?

- What brings you the most fulfilment – and how is that related to money?

- If you didn’t have to work for a living, what would you do with your time?

Take your time. Use your journal. Dig. Keep asking the same question until you run out of answers before going on to the next one.

Step 4: Three Questions That Will Transform Your Life

- Did I receive fulfilment, satisfaction, and value in proportion to life energy spent?

- Is this expenditure of life energy in alignment with my values and life purpose?

- How might this expenditure change if I didn’t have to work for money?

Each of these questions points to a facet of your dreams.

- Question 1 provides a way to evaluate your expenditures. It asks if your spending is bringing you the kind of happiness you feel when you are living your dream.

- Question 2 asks if this spending is taking you in the direction of your dream. This question is illuminating. It gives a concrete way of looking at whether you’re practising what you preach.

- Question 3 asks you to imagine how this spending would change if you no longer had to make money to support your lifestyle. This question evaluates how much your job costs you and focuses more clearly on your life apart from work.

MONEY TALK QUESTIONS: Your dreams, values, memories, and goals make for endlessly interesting conversations. If you hear a dream or goal you like from someone else, steal it! Together we can build compelling visions for a really good life.

- What did you want to be when you grew up? What about now?

- What’s on your “bucket list”, those things you want to do before you die?

- What is your calling, the work of your heart and soul?

- Talk about one of your happiest memories. What made you happy?

- What could happen our of the blue that would be like a dream come true?

- What do you want for your children/ loved ones that money can buy?

Getting It Out in the Open

Step 5: Making Life Energy Visible

Anyone who has undertaken any behavior change knows three keys:

- Make it a habit rather than a choice.

- Be Accountable to someone else. Nosiness can be interesting and effective.

- Chart. Checking off a Daily to-do list. Keeping track does wonders for quelling the urge to splurge.

In Step 5 you make visible the results of the previous steps, plotting them on a graph that gives you a clear, simple picture of your financial situation, not and over time, and the transformation in your relationship with money (life energy).

When your spending and your goals are in alignment, you have an experience of wholeness and integrity; you feel good about yourself.

GETTING YOUR FINANCES OUT IN THE OPEN: Now that charting has become a habit, even a pleasurable one as you see your progress, you can add the element of accountability. How?

- Open the subject with a friend via a Money Talk.

- Posting your monthly accounting on a blog.

- You can even start out with having your chart in the closet – keeping their financial affairs private while still provide a reminder everyday that they want to be conscious in their handling of money.

The chart becomes a representation of how well you are living your values.

Financial Independence As a By-Product of Doing the Steps: People who put the steps of this program into practise report that the process of transforming their relationship with money becomes both challenging and fascinating.

In the strictest sense, Financial Independence means having a choice of wha you do with your time because you have an income sufficient for your basic needs and comforts from a source other than paid employment. But there are other aspects of FI, such as getting out of debt and accumulating savings.

MONEY TALK QUESTIONS

- How much money do you need to be happy?

- What or who can help you change your relationship with money?

- What might change if you could know what others – a friend, date, boss, stranger – earn?

- What motivates you to save?

- What helps you save money?

The American Dream – on a Shoestring

It is both sad and telling that there is no work in the english language for living at the peak of the fulfilment curve, always having plenty but never being burdened with excess. The wealth we enjoy today is the result of centuries of frugality. Frugality means enjoying what we have. Frugal people, make sure to get the full plaque from everything.

Keep this in mind as we explore ways to save money. We aren’t talking about being cheap. We are talking about creative frugality, a way of life in which you get the maximum fulfilment for each unit of life every spent. In the end, this creative frugality is an expression of self-esteem. It honours the life energy you invest in your material possessions.

Step 6: Valuing your Life Energy – Minimizing Spending

This step involves the intelligent use of life energy (money) and the conscious lowering or elimination of expenses.

One sure way to SAVE MONEY: Stop Trying To Impress Other People

Ten sure ways to SAVE MONEY:

- Don’t go shopping, unless it’s really necessary and you need something from the store.

- Live within your means: this notion means that but only what you can prudently afford. Avoid debt unless you have an assurance that you will be able to pay it promptly.

- Take care of what you have: There is one thing that we all have that we want to last a long time: Our Bodies. Similar to that try to take care of the stuff you have like your computer, your car. Make sure you spend enough time and resources to take care of these to increase the life of these devices and appliances.

- Wear It Our: Whenever you are planning to buy something new, first ask yourself what you already have can it be a used a little extra so that you don’t have to buy this new thing now. Try to increase life of your possessions by at least 20% extra.

- Do It Yourself: Can you replace a bulb or other simple part in you car? Fix a plumbing leak? Basic Survival and living skills can be learned through books, websites, online courses, adult education classes, and the world’s growing repository of how to make or fix everything, YouTube.

- Anticipate Your Needs: Forethought in purchasing can bring significant savings. With enough lead time you will likely find the items you need at a cheaper price. Anticipating your needs also eliminates one of the biggest threats to your frugality: impulse buying.

- Research Value, Quality, Durability, Multiple Use, and Price: Research your purchases. Read Reviews, comments. Decide what features are most important to you. Don’t just be a bargain junkie and automatically buy the cheapest item available.

- Buy It for Less: There are numerous ways to get what you need for less:

- Comparison-Shop

- Ask for discounts

- Buy second Hand

- Meet Your Needs Differently: Substitution isn’t a limitation. It’s liberation

Managing Debt and Your Finances: A cardinal rule of frugality is to avoid debt. Some forms of debt can be viewed as an investment if the money you borrow enables you to buy an asset that appreciates in value or boosts your earning power.

Eating: Once you begin tracking your expenses, you’ll see how much eating can cost. Making the time to enjoy cooking meals at home and even entertaining friends that way instead of going out is a sure way to save money and improve your health.

Gifts and Celebrating: For many people, giving gift is an important way to express love. However, you can cut back on the cost of gifts without cutting back on the affection behind them.

MONEY TALK QUESTION:

- Whom are you trying to impress or please through what you have or how you spend?

- How do you economize? On what? How do you feel about it?

- Talk about on thing that or own that you love. What do you love about it?

- Take us shopping with you, describing where you are, how you feel, what you buy.

- What’s the last item you actually wore out?

For Love or Money: Valuing Your Life Energy – Work and Income

Work has two different functions: The Material, financial function (I.e., getting paid) and personal function (emotional, intellectual, psychological and even spiritual).

Growth potential, communication channels, interest in work, and recognition make a job satisfying – not pay.

- Redefining work increases choices: Being able to acknowledge who you really are allows you to reevaluate how you have structured your career.

- Editing work allows you to work from the inside out: As you come to know yourself, your values, your beliefs, your real talents, and what you care about, you will be able to work from the inside out. You will be able to do your job without giving up your self.

- Redefining Work makes us life Designers, Not just Wage Earners

- Redefining Work Adds Life to your Retirement

- Redefining Work Honours Unpaid Activity.

- Redefining Work Reunites Work & Play

- Redefining Work Allows you to enjoy your Leisure more.

- Redefining Work sheds a new light on “Right Livelihood”.

Step 7: Valuing your Life Energy – Maximising Income

When you are working for pay, you should make the most money per hour possible, consistent with your integrity and your health.

Higher Pay: A matter of Attitude

Many people are passive, even fatalistic, about the size of their earnings. They act out of a victim mentality, totally at the mercy of outside forces – the boss, the wage scale, the unemployment situation, the recession, the poor local economy, and on and on and on.

One important factor limiting your earning potential is attitude: attitudes about yourself ( e.g., “I’m not good enough”), etc. If you see yourself as a victim, you may well be too busy feeling sorry for yourself to notice the many opportunities to change your dismal destiny.

To be successful, cultivate positive attitudes of self-respect, pride in your contribution, dedication to your job, cooperation with your employers and coworkers, desire to do the job right, personal integrity, responsibility and accountability- and do it just because you value your life energy.

MONEY TALK QUESTIONS

- How could you double your income without selling your soul or compromising your health?

- What was your first job? Best job? Worst Job?

- What would be your dream job – whether or not you were paid for it?

- What is work and why do we do it?

- What is your life’s work?

- What do you like and dislike about the work you do for money?

Catching Fire: The Crossover Point

Doing step 1 through 7 transformed your relationship with Money. Now step 8 and 9 will transform your relationship with your future.

Step 8: Capital and Crossover Point

Each month, apply the following formula to your total accumulated capital and record the result on your wall chart:

- Total accumulated capital is simply the money you have accumulated in your savings account that you are not planning to spend.

- For current interest use the current yield of long term (thirty years) interest rate of US treasury bonds or certificates of deposits.

WHERE DO YOU ACTUALLY PUT YOUR SAVINGS?

During your wealth accumulation years, first build Liquide cash in bank account – call it an emergency fund. Next, consider an individual retirement account (IRA), which provides tax advantages and grows tax-free. Also, Purchase laddered CDs (Certificates of a deposit with staggered maturity dates), or Index Funds.

MONEY TALK QUESTIONS

- What ideas – practical to wild – do you have about how you’d pay off all your debt?

- What do you want your legacy to be?

- If you didn’t have to work for living, whatwould you do with your time?

- If you could take a year of work, how would you spend it?

- What skills or social network could you build now to depend less on money to meet your needs?

Where to Stash Your Cash for Long-Term Financial Freedom

Step 9: Investing for FI

Become knowledgeable and sophisticated about long term income producing investments that can provide a consistent income sufficient for your needs over the long term.

Set up your financial plan using the pillars:

- Capital: The income-producing court of tour Financial Independence.

- Cushion: Enough ready cash, earning bank interest, to cover six months of expenses.

- Cache: The surplus of funds resulting from your continued practice of the nine steps.

MONEY TALK QUESTIONS

- What are you putting in place now to keep you afloat as your age?

- In a pinch, what could you do to make extra money?

- Win or what you trust to help you invest your money?

- What’s been your experience to date with investing? What are your hopes?

- What values and beliefs do you bring to investing?

- What is your risk tolerance-in money and life?

- What does financial independence mean to you?